US President Donald Trump has recently called on NATO countries to impose steep tariffs of 50-100% on Chinese imports as a means of stemming its tacit support for Russia’s war in Ukraine. Furthermore, Trump – and other Western observers before him – view such a policy of secondary sanctions as a means to pressure Beijing into likewise pressuring Moscow to stand down in Ukraine.

In theory, such calls are logically sound. China has indeed become a crucial economic lifeline to Russia: China’s share of Russian foreign trade nearly doubled between 2021 and 2023, reaching over one-third of the total by 2024. China has absorbed much of Russia’s exports sanctioned by Western countries – particularly oil – and provided Moscow with crucial dual-use goods, both of which have proven indispensable to the functioning of Russia’s wartime economy. In practice, however, a tariff or sanctions regime by NATO members against China would be unlikely to achieve this goal and would likely backfire badly on Alliance states.

China’s economy is huge, diversified, and deeply integrated into global markets. China accounts for over 18% of global GDP and stands as the world’s largest trader of goods. In recent years,

China’s manufacturing sector has expanded significantly in size and quality, with Chinese firms leading in many advanced technological goods, such as EVs.

In accordance with its core geopolitical calculations, Beijing has endured over time to build safeguards against foreign economic pressure. China maintains enormous foreign-exchange reserves, has increasingly promoted international use of the renminbi (RMB), developed a separate financial infrastructure for settling cross-border transactions, and even passed anti-sanctions laws that seek to penalize Chinese compliance with foreign penalties. All of this makes China very difficult to target with sanctions as a tool of economic statecraft.

Furthermore, China has been deliberately moving to reduce its economic dependence on exports, especially to the West. Since 2020, Chinese planners have emphasized a “dual circulation” strategy that prioritizes bolstering domestic demand. The upcoming 15th Five-Year Plan is expected to double down on this strategy by increasing subsidies, raising wages, and expanding social welfare to boost household spending. In practical terms, this means that even if access to Western markets was curtailed, China expects its huge internal market and new high-tech industries to drive growth.

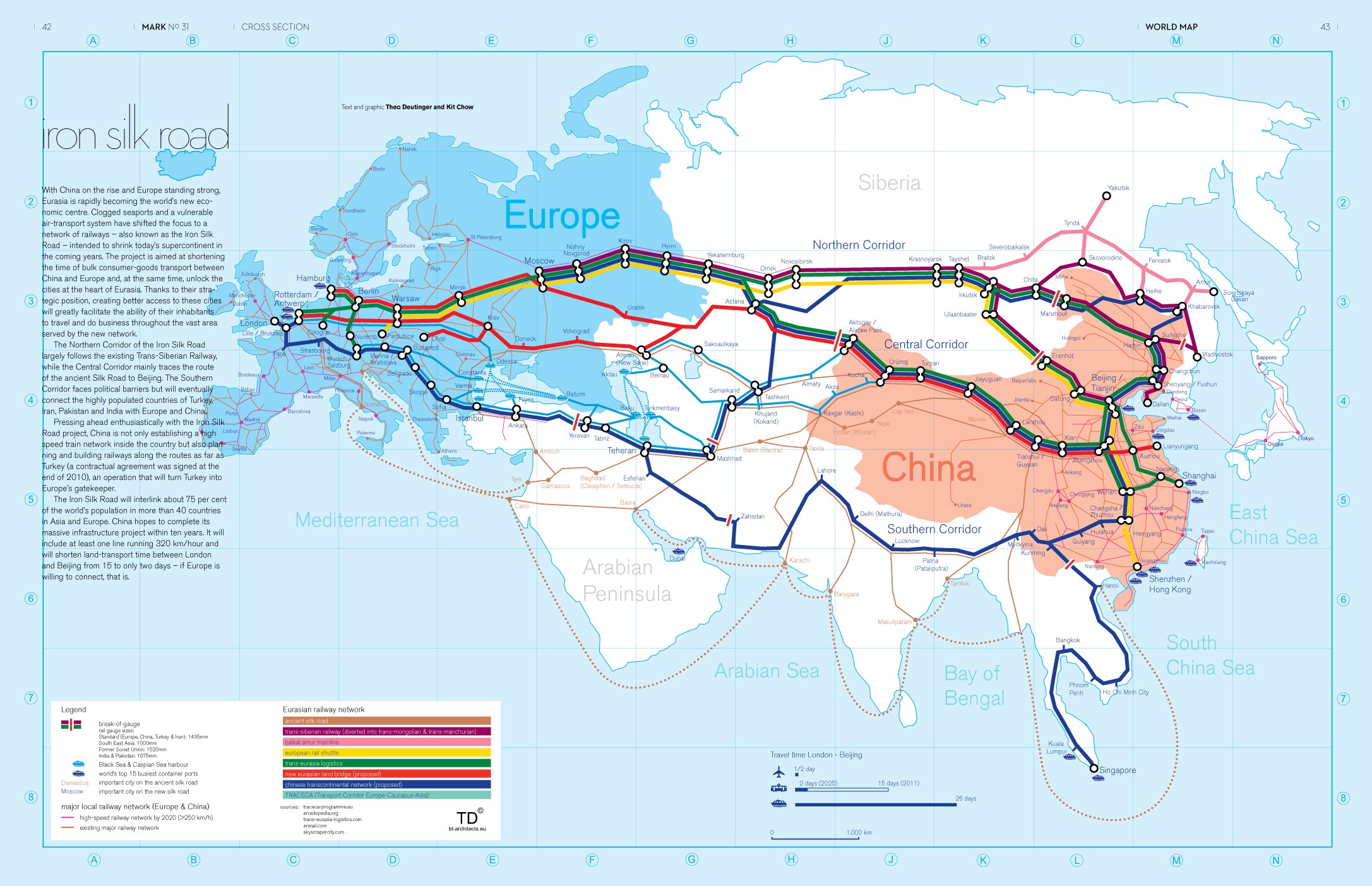

At the same time, China’s global trade network is far from confined to the West: by 2024, approximately half of China’s trade was with Belt and Road Initiative (BRI) partner countries, which are predominantly in the Global South. If the West enforced an embargo – de facto or de jure – against Chinese goods exports, China could simply reroute more trade through friendly states. Notably, recent friendshoring efforts by the US and allies have adjusted their supply chains to source from countries (e.g., Vietnam or Mexico) that themselves import heavily from China. For instance, as US companies moved orders to Vietnam, Vietnam was substantially increasing its imports from China. The upshot of this is that goods labelled from countries other than China still heavily contain – and depend on access to – Chinese components. This supply-chain interconnectedness means Western tariffs or sanctions on China would likely be easily circumvented.

Under such a tariff or sanctions regime, the economic pain for the West would be substantial. China is deeply woven into Western supply chains and consumer markets. On the consumer side, a broad tariff on Chinese imports would act like a large tax. One analysis of the first salvo of the US-China trade war in 2018-19 estimated that such tariffs cut about 1% from US GDP and amounted to roughly US$1300 per American household in increased costs. Similar studies have noted that many previous US or EU tariffs on Chinese consumer goods, from electronics and appliances to clothing and cars, caused adverse economic consequences. For the average citizen, tariffs mean higher inflation, which is a major source of economic pain.

Western industries would also be hit: factories designed for integrated global inputs would face critical shortages if access to China were cut back. For instance, Germany’s automotive sector relies heavily on parts from China; it is possible that restrictions on Chinese imports could halt vehicle production in Germany if German factories were to lose access. Likewise, high-tech manufacturers in the US and Europe would scramble if key Chinese equipment or materials

were cut off. Overall, sanctions or tariffs on China would likely disrupt supply chains, raise unemployment in exposed industries, and fuel economic slowdown in Western countries.

China would not stand idly by in the face of a Western embargo, and would in fact be likely to retaliate strongly. China has already shown a willingness to use countermeasures when it feels attacked. A salient recent example is found in Canada. After Ottawa imposed tariffs on Chinese EVs and steel, Beijing responded by levying massive tariffs on certain Canadian agricultural exports. In March 2025, China announced duties on C$2.6 billion of Canadian food and farm products, including a 100% tariff on Canadian canola – the severity of which is highlighted by the fact that over half of Canadian canola exports go to China. The result was a devastating blow to Canadian farmers, costing Canadian jobs and revenues. Australia likewise faced years of Chinese export bans after political disputes, which also severely affected Australian producers. If NATO member states imposed tariffs on China, Beijing could retaliate by targeting key exports of each ally. Any economic blow inflicted on China would be matched in kind by reciprocal actions against Western countries.

Beyond Chinese retaliatory capabilities, achieving a unified response would be daunting. Any country facing significant economic pain from a Chinese embargo would have ample incentive to opt out. Powerful industry groups and union leaders would lobby leaders to back down. Examples abound: German automakers already worry that hostile policies towards China could wipe out billions in sales and thousands of jobs, which is taken into consideration by Berlin when determining its China policy. Similarly, Canada’s large commodities sector also depends on Chinese demand, and many Canadian producers fear their domestic industries would collapse under Chinese countermeasures. The entire tariff concept hinges on strong NATO unity, but the moment one major economy balks due to domestic cost, any collective regime is likely to unravel.

History offers a powerful analogy. In 1806, Napoleon ordered the Continental System, an embargo cutting off Europe from British trade to cripple Britain’s economy. In reality, the policy largely backfired. Britain simply redirected its trade globally via its vast empire and continued to prosper. European countries enforcing the blockade, conversely, suffered severe hardship – industries closed and food prices soared as crucial British imports dried up. Many European states quietly ignored or resented the rules once they saw their own economies shrink. This episode illustrates that trying to economically isolate a large trading power can hurt the isolators more than the target.

Modern parallels are also instructive regarding the effectiveness of sanctions or tariffs against China. For decades, Cuba has survived a US embargo with no regime change, meaning the embargo has failed to meet its strategic objectives. Likewise, North Korea and Iran endure sweeping global sanctions yet remain defiant and resilient. If smaller states can withstand such measures, China is substantially less likely to capitulate given that its capabilities are staggeringly more robust.

In sum, a NATO secondary sanctions strategy against China would be at best ineffective and at worst counterproductive. It would inflict pain on Western consumers and businesses, strain the unity of the alliance, and almost certainly provoke Chinese retaliation that would reverberate back at NATO economies. The smarter course for NATO is not to replicate the very economic nationalism it seeks to counter. Building resilient supply chains, investing in innovation, and engaging China where interests align would do more to constrain Moscow – and strengthen the Alliance – than any tariff ever could.

Photo: Russian Presidential Press and Information Office, www.kremlin.ru

Disclaimer: Any views or opinions expressed in articles are solely those of the authors and do not necessarily represent the views of the NATO Association of Canada.