The Keystone XL Pipeline has posed controversial environmental, cultural and economic issues for Canada over the past few months, and the future of international relations will rely on both the trade of Canadian oil and the plans the U.S. President Elect has for his country’s energy.

Canada’s economy banks heavily on the extraction and exportation of oil. With energy trade as part of Canada’s economic equation, the current trade deficit is $3 billion. Take energy out of the equation, and the result would be a trade deficit of $7.3 billion. The U.S. is the biggest buyer of Canadian oil, receiving the bill for 94% of Canada’s energy exports.

Comparatively, Canada supplies only 40% of the U.S.’s oil imports, clearly exposing the fact that the United States is less reliant on Canada than Canada is on the U.S.

Canadian oil is sold at a large discount to the U.S. to compensate for the challenges of transporting heavy oil from its landlocked position in Alberta.

To provide a solution to the transportation issue, Canada has been campaigning for a new pipeline (Keystone XL), which would stretch from the Alberta oil sands to the Houston refineries. Trump has expressed his approval for the proposed pipeline, previously declined by his predecessor. The likelihood of approval has increased since Trump announced his upcoming Secretary of State to be the current ExxonMobil CEO, Rex Tillerson.

However, despite the hope of increased export that the pipeline offers, Canada may still need to find a new trade partner since Trump has revealed his plans for the U.S. to become an exporter of oil in the next 10 years. Trump states, “under my presidency, we’ll accomplish a complete American energy independence”.

Recently Trudeau, Canada’s Prime Minister, may have opened up such an opportunity for a new trade partner by approving the Trans Mountain Pipeline that would enable Alberta’s oil to be transported to the West Coast at a rate of 890000 barrels per day.

The coastal end point would allow large quantities of Canada’s oil to be transported by tanker to oil thirsty Asia. China rates as the second highest country for oil consumption, following the U.S. alone.

China imports oil predominantly from Saudi Arabia, an OPEC country which recently vowed to make cuts of 4.6% in production.

The news of the OPEC production cuts bodes well for the Canadian market. Despite the possibility of the U.S.’ competing for Asia’s trade deals, Trump’s recent relations with China may have already ruled out any chance of a future trade relationship between China and the United States. Trump has thrown around talk of starting a trade war against China by cutting and taxing Chinese imports, stunting their already brittle relationship.

The Middle East holds 30% of the global market share of oil. The establishment of the U.S. as a stable oil producer may reduce trade and involvement between the Middle East and the United States. Much of the U.S. interest in the Middle East has been driven by the need to stabilize oil prices. U.S. involvement in the Iraq war was influenced by the power of Iraq’s vast oil supply.

Saudi Arabia is the world’s oil giant, and has a deep relationship with the U.S. that began over securing an oil trade relationship. Saudi ensures the U.S. dollar is used in all petroleum transactions, in return for receiving help with political stability. Political scientist J.W. Baker states that:

With independence, the U.S. would be less reliant on trade deals with OPEC countries, resulting in less need for the U.S. to stabilize political relations in the Middle East. This may leave some countries in limbo between old promises and new opportunities.

As for now, the future of Canada’s oil industry remains uncertain. Will Canada’s future lie in securing its trade relationship with the U.S., or in forming new promising unions with some of the U.S. abandoned relationships?

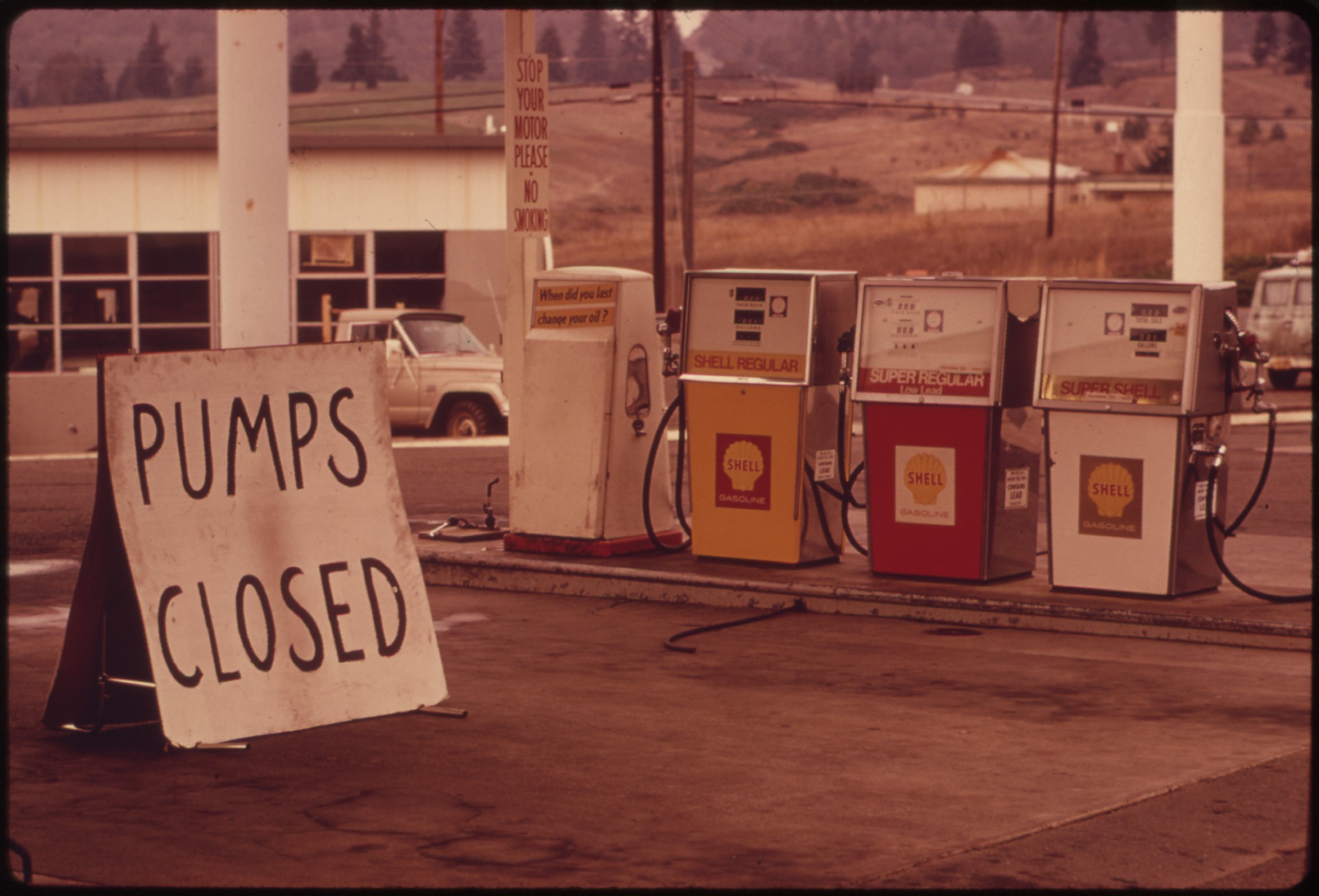

Photo: “Oil well pump jacks” (2008), by Richard Masoner via Creative Commons. Licensed under CC BY-SA 2.0.

Disclaimer: Any views or opinions expressed in articles are solely those of the authors and do not necessarily represent the views of the NATO Association of Canada.